YOUR IMPACT, YOUR DATA. DIGITAL BY DESIGN

Digital solutions for data collection and effective impact data management - digital by design - to understand your clients, design

innovative green financial products and measure your impact

Review our webinar series on Sustainable Finance in the MENA region

Review our webinar series on Sustainable Finance in the MENA region

Our mission is to empower microfinance institution to develop green financial products

targeting the needs of their customers.

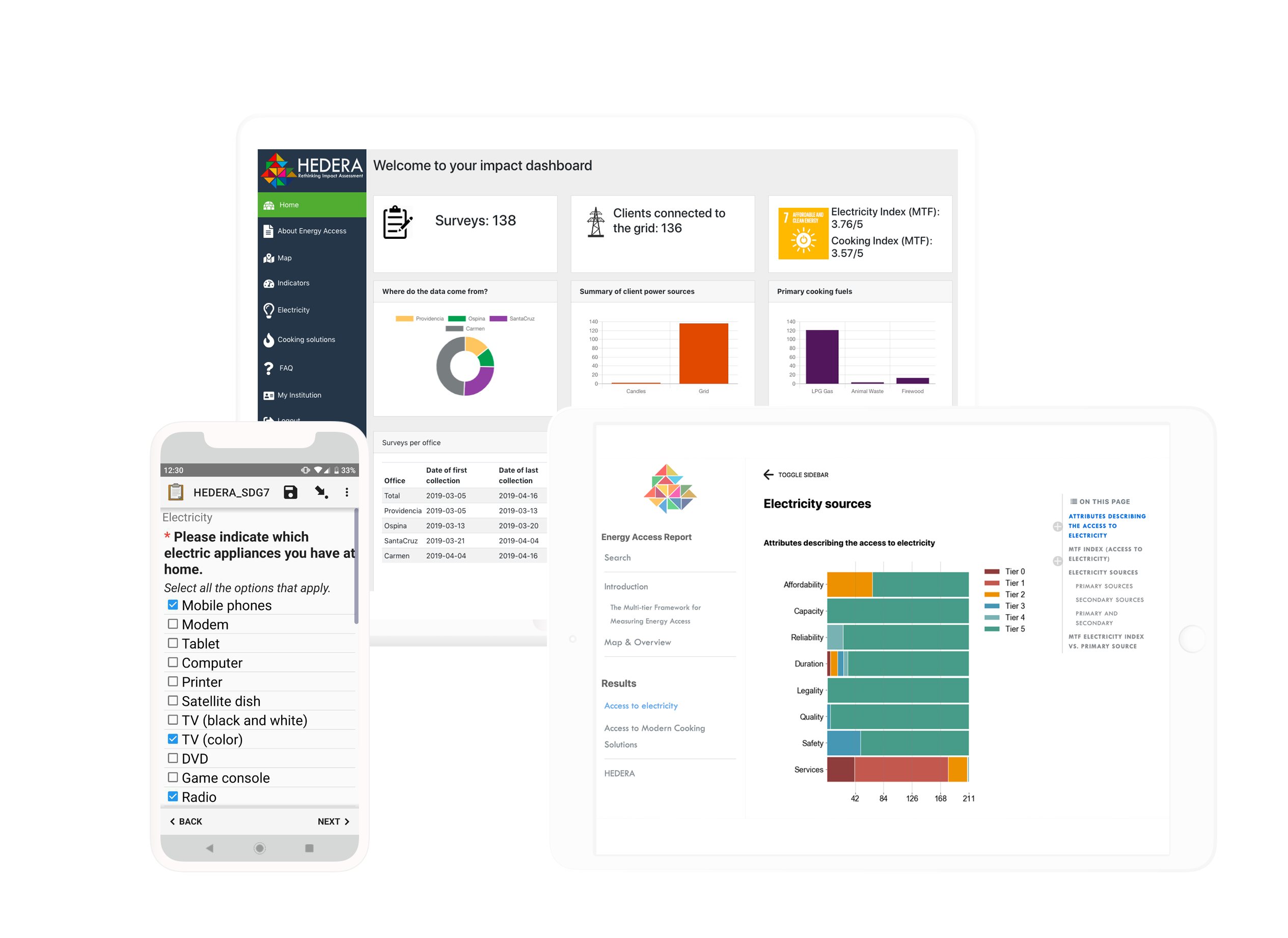

We help microfinance stakeholders collect high quality data, at the household

and the organization level, providing mobile and web versions of standard questionnaires

based on the latest SDG frameworks.

Our automated cleaning, analysis, and reporting tools support microfinance institutions and investors

streamline impact data management processes, simplifyng baseline assessment, market research, and impact reporting.

We want to make impact monitoring affordable, easier, scalable, and more transparent.

IMPACT DATA MANAGEMENT

Know your beneficiaries. Track your results. Improve your impact.

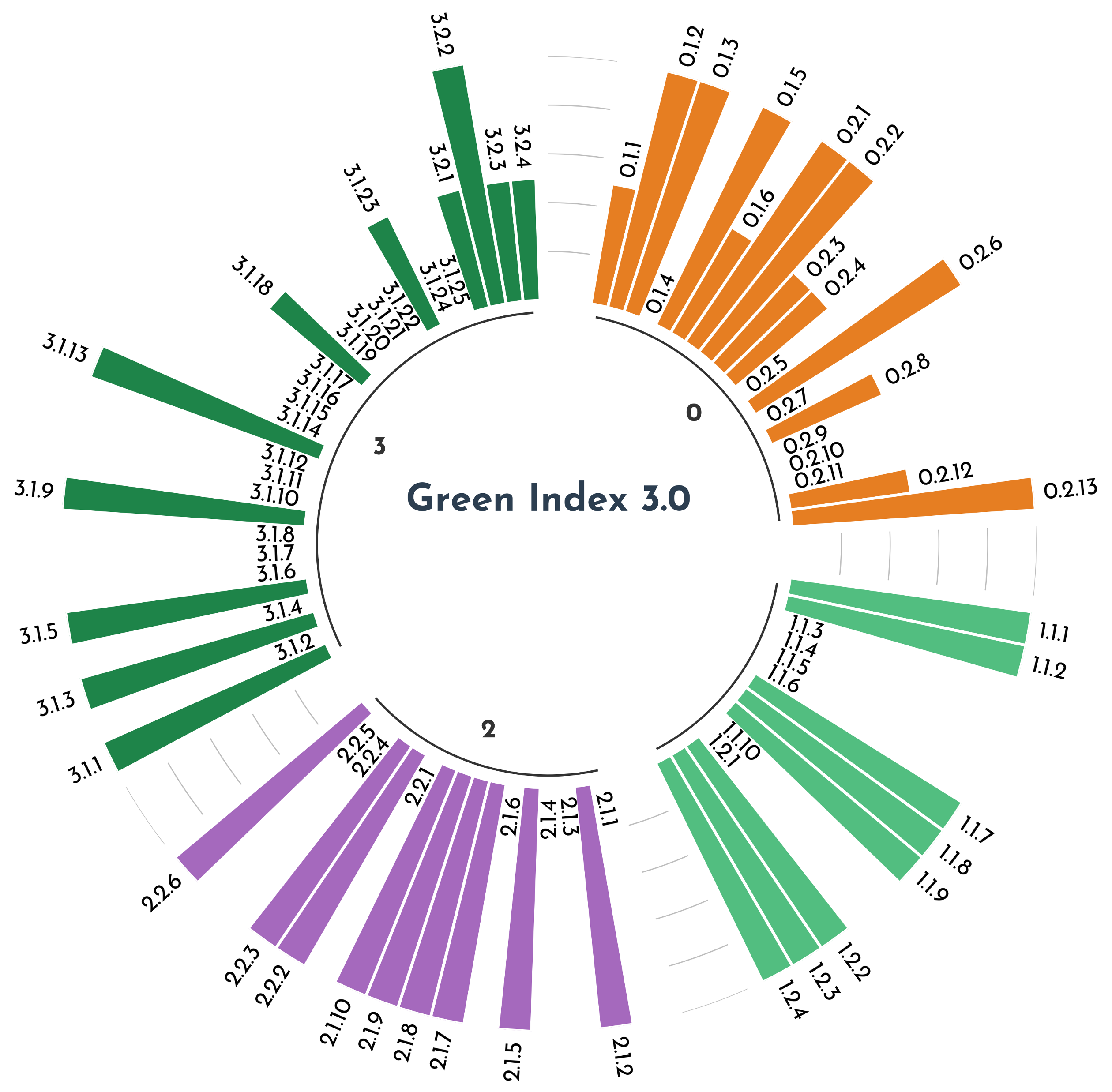

Our unique impact toolkit enables you to collect, analyze, and report standardized,

household-based, & internationally recognized sustainability metrics.

Easy to use. Customized to meet your needs.

HEDERA TRAINING

The HEDERA training platform enables the creation, management,

and monitoring of training materials and provides a space for knowledge

exchange and follow-up on brief and long-term trainings.

Create your own sessions and users. Train your staff remotely.